VOICE BIOMETRICS A CRITICAL TECHNOLOGY FOR FIGHTING FRAUDS AND CYBERCRIME

Voice biometrics is an emerging technology that uses the unique characteristics of a person’s voice to identify them. Among the most common biometrics, such as voice, face, and fingerprint, Voice biometrics is especially promising because it is non-invasive, easy to use, and portable. Whether an individual or a company, voice biometrics is vital to preventing bank fraud and cybercrime. With the advancement of technology, a person’s voice is now one of the best ways to identify a person.

The financial services industry is one of the most significant users of biometrics. The global adoption of smartphones has led to a dramatic increase in fingerprint and facial biometrics used for security purposes. Besides fingerprints, other biometrics such as iris patterns and face recognition are also being used for verification purposes. However, these methods are not entirely secure, and they may become vulnerable to deep fakes. As a result, banks are looking for new ways to reduce their fraud and identity theft risks. One of the best ways to do this is through voice biometrics. The use of voice authentication can significantly improve security over knowledge-based authentication methods.

Unlike other biometric methods, we can use voice biometrics in any situation where it’s important to verify identity, such as banking transactions, customer service calls, e-commerce purchases, and voting. In the future, we could use it to secure access to our homes and cars and secure facilities like hospitals and airports. Besides, preventing fraud in telecommunications and financial services; we could also use voice to authenticate users when logging into computers, apps, or websites, And also to verify identity when applying for jobs or access government services and to track employees’ whereabouts and movements throughout the day

Other benefits of using voice biometrics include a)Scalability: Voice biometrics are easy to scale up or down as needed, which makes them especially useful for low-cost services that need quick deployment. b) Security: Unlike other forms of authentication (like passwords), voice biometrics are impossible to spoof or copy, which makes them more secure than traditional password authentication methods. C) Privacy: Unlike conventional authentication methods (e.g., passwords), voice biometrics don’t require users to reveal any personal information about themselves, making them a privacy and friendly option for users who are concerned about privacy and security.

Passwords are the weakest link in security, particularly considering the number of apps, services and accounts people use today. It’s easy to blame internet users for using easy-to-remember passwords or reusing the same password on many different sites. Password reuse makes a hacker’s job easy because reuse password is like having a key which can unlock other rooms. Unlike passwords, a customer’s voice is far more challenging to hack. By analysing the caller’s voice during a call, biometrics verify the caller’s identity and suspicious flag calls.

Voice biometrics can be one of the critical technologies for fighting fraud and cybercrime. Voice can help financial institutions ensure higher levels of protection for their customers and employees. It can also help prevent fraudulent insurance claims. HSBC UK introduced a voice biometrics solution to their telephone banking services to help them prevent fraudulent transactions. The result was that telephone banking fraud cases fell by over 50% in the first half of 2021. The extra layer of security provided by voice biometrics has saved UK banks from losing £249 million of customers’ money in 2020 alone. Scammers are constantly developing clever ways to get their hands on data. In a recent survey, 81% of hacking-related breaches involved weak passwords. Several companies abroad, such as Chase, Wells Fargo, and Schwab, have begun using voice biometrics to prevent fraud and improve customer experience, as customers no longer have to remember complicated passwords to access their accounts. Voice biometrics is the fastest software technology to verify the identity of a user. It can analyze voice samples to identify the identity of a caller in seconds. The voice biometrics industry has grown exponentially in recent years. The market is expected to reach a market size of $3.9 billion by 2026, with a compound annual growth rate of 22.8%.

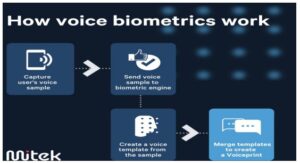

As an authentication solution, voice biometrics might be what companies need to protect themselves from criminal attacks. VB can make it easy for banks and companies to verify their customers while on call because it relies on speech patterns to identify each caller rather than passwords, codes or other knowledge-based identification systems. Voice verification is of two types, namely active and passive. In the dynamic method, the caller utters a phrase on the company’s request, which the system recognises and authenticates. The second method is passive, where the system performs an identity check in the background when the customer converses with the bank or company. The latter does not seek PIN codes or passwords and automatically verifies the customer while he is chatting with the support agent over the phone. For this, the customers have to enroll their voices to enable the system to store their voice print in the database to match or verify with the future calls of the customer.

During verification, the system will alert the employees or security about a suspicious caller if the voice fails to match the voiceprint. For instance, if the customer answers the customer details and the security questions but the voice does not match, there is a fraudster online who has to be dealt with by security or law enforcement. Yet another significant advantage of using voice biometrics is that organisations or law enforcement can build a database of known voiceprints of fraudsters and spot them whenever they attempt a new fraud and take appropriate action.

But if there isn’t, the system will alert employees that there is a suspicious caller on the line. For example, suppose the caller knows the exact customer details (such as the answers to security questions) but fails the biometric verification. In that case, your support team can be alerted that there’s very likely a fraudster on the line, and they can notify the management. Hence, Passive voice biometrics offers a practical method for preventing telco fraud.

There is a rising trend of using voice-biometrics in forensics and police investigation. By identifying and tracking individuals with voice recognition technology, police can better respond to and prevent crimes before they happen. For example, by monitoring public announcements, they can identify and deter criminals before they strike. Voice biometrics has potential uses in various ways, including security systems, cash registers, and electronic voting systems. Using voice biometrics could play a key role in preventing crimes of all kinds. These tools are helping law enforcement officers to improve their efficiency in criminal investigations. They also allow for building large databases of known criminals and persons on watch lists. These technologies have also reduced the time to identify a speaker.

Voice-biometrics in forensics and police investigation can also help to identify suspects in cold cases. The audio recording may not be able to be used for identification, or the person may change his or her voice for some reason. This can make the identification difficult. However, experts can compare the voice characteristics and provide evidence to the court. This can help the court determine whether two recordings are from the same person. Forensic voice analysis also includes speaker profiling. This technique involves analyzing the background of a speaker by examining the dialect of his or her voice. Using the speaker’s background, an expert can identify whether the two recordings are from the same person. In a recent study, a voice profile was extracted from a voice recording of an emergency call in the George Zimmerman case. The speaker profile helped an expert in the case to determine that the speaker was a Cuban national. It also helped him to identify the speaker as a native of the eastern United States.

The technology works by creating a digital voiceprint and comparing it to a customer’s voice. It then flags calls to an operator as fraudulent. The system is not 100% foolproof. Some voice biometrics will produce false positives. The system will also have a real-time risk score that indicates whether or not a call is likely to be fraudulent. The most accurate system should be able to detect a cloned voice sample. The cost of the system will vary according to the number of voice prints in the fraudster database and the response time.

Aside from the obvious benefits, voice biometrics are also a good way to identify professional fraudsters. This is important because most frauds involve call centers. The average time for a caller to reach a customer service agent is 17 minutes. With voice biometrics, the time taken to identify a caller is reduced. This means that call centers can serve more callers at a lower cost. One of the best features of voice biometrics is that it does not tie you to a particular device. This means that if your mobile phone is stolen, you can still authenticate yourself with voice biometrics. This is important for call centers because criminals often change their pin codes to access their accounts. Another benefit is that it is very easy to verify a caller’s identity. In the past, this has been a tedious task. However, with voice biometrics, customers can verify their identity in seconds. This makes the process more convenient and increases customer satisfaction. With Voice biometrics, the customers don’t have to answer a series of questions or share personal data over the phone to identify themselves. The system will identify the customer in less than three seconds. A scammer, even if he intercepts the OTP or receives the notification by impersonating the actual customer device, would still be unable to complete the voice authentication process.

Voice biometrics rely on something far more difficult to steal, though – a customer’s voice. By analyzing a caller’s voice in the background during an entire conversation, voice biometrics can prove if the caller is who they claim to be in a matter of seconds and immediately flag all suspicious calls. As a bonus, voice biometrics can also make customers far more vigilant. For example, suppose they know that their bank or support center uses voice biometrics to identify them. In that case, they will be far more careful whenever someone asks them for their bank details or login information for “verification procedures”. After all, why would a “Telco technical support employee” need the customer’s login details instead of just running a voice check to identify them? Voice biometrics is one of the most promising new technologies in crime prevention. It’s an automated, irrefutable way to identify people by their voice. Law enforcement can use voice biometrics to quickly identify criminals using disguises, drugs, or other tactics to mask their voices. Voice biometrics is gaining increasing use for everything from criminal background checks to airport security. Detecting a person’s voice on the phone is much more reliable and accurate than a visual scan of a person’s face. Face recognition technology tends to have a high error rate and is often inaccurate – it only works when the person getting scanned is looking directly at the camera. Voice recognition technology has a much lower error rate and requires no eye contact. Whether you’re talking to yourself or on the phone, it’ll be easy to tell if you’re talking to someone else. Voice biometrics can help law enforcement and other agencies build trust with the community. People are more likely to report suspicious behavior if they know identification will be swift, voice biometrics can help stop crimes before they start.

Conclusion

Voice biometrics is a type of biometric technology law enforcement agencies can use to identify people based on their voices. Voice biometrics is distinct from traditional biometrics, such as fingerprints and facial recognition, in that it does not require machines to scan the physical body for signs of identity. Instead, voice biometrics relies on a person’s vocal characteristics to identify them. As fraudsters keep getting smarter, so does the technology. Banks and companies can identify suspicious callers by comparing their voice prints with the voice prints of the account holders available with the banks and prevent them from having their way. So any bank or financial institution, or company that wants fraud protection can achieve the desired security without compromising the user experience. Therefore, a biometric system is the most intelligent investment any bank can make because it spares their customers from answering vexing questions, flags suspicious callers, and provides the organisation with speed, accuracy and safety.

Dr.K. Jayanth Murali is a retired IPS officer and a Life Coach. He is the author of four books, including the best-selling 42 Mondays. He is passionate about painting, farming, and long-distance running . He has run several marathons and has two entries in the Asian book of Records in full and half marathon categories. He lives with his family in Chennai, India. When he is not running, he is either writing or chilling with a book.

Dr.K. Jayanth Murali is a retired IPS officer and a Life Coach. He is the author of four books, including the best-selling 42 Mondays. He is passionate about painting, farming, and long-distance running . He has run several marathons and has two entries in the Asian book of Records in full and half marathon categories. He lives with his family in Chennai, India. When he is not running, he is either writing or chilling with a book.